Stocks pushed to new highs this week as investors welcomed news of Iran-Israel ceasefire and a US-China trade deal. Less than three months ago at the height of Trump's tariff chaos, the prospect of stocks reaching new highs in late June seemed improbable to say the least. But the early April low may well have marked a significant bottom after Trump's opening salvo in the trade war turned out to be just another negotiating tactic.

The new market highs roughly coincide with several key planetary alignments. We are now a little past the simultaneous double square of Jupiter-Saturn and Jupiter-Neptune which was exact on June 15-18. Last Tuesday's Sun-Jupiter conjunction reiterated this larger alignment and may have acted as a kind of bridge for the energies of the other planets to manifest.

Nonetheless, my previous studies suggested a bearish bias in the aftermath of these Jupiter alignments. Clearly, we have yet to see any downside as these squares begin to separate and weaken. The Sun-Jupiter conjunction may have therefore postponed the double Jupiter square bearish fallout. The other interpretation to the current bullishness may simply be a normal trend anomaly. While the bearish effects of the separating Jupiter-Saturn and Jupiter-Neptune squares were measurable, they were not very strong -- around 60-65%. That means that 35-40% of the post-alignment results were actually bullish. And given the small sample size, it is quite possible that the period following the squares might not prove to be bearish at all.

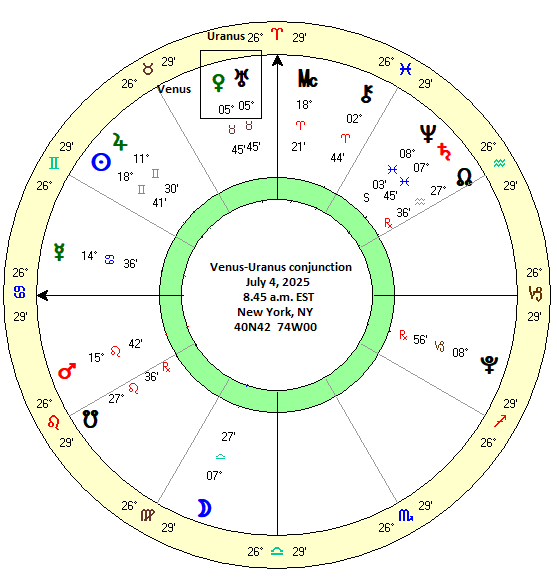

This week upcoming will be another opportunity to observe the effects of the double Jupiter square. Unlike last week, there will be no additional conjunctions to Jupiter, Saturn or Neptune. In the absence of any other transits, it is a bit more likely that the bearish effects of the separating squares may manifest. However, we should note that the Venus-Uranus conjunction on Friday, July 4 may have a bullish bias. While this conjunction of bullish Venus and neutral Uranus is often considered a bullish influence by astrologers, it would be useful to know the magnitude of its bullish effects.

The Venus-Uranus conjunction: Bullish?

To that end, I analyzed the previous 66 conjunctions from 1960 to 2024. Since Venus is a fast-moving inner planet, I chose a series of short, 2-day time intervals for the purposes of price comparison. Since Venus moves about one degree per day, a 2-day interval would equal two degrees of arc and therefore a close conjunction. Most astrologers regard a 10-degree conjunction as the maximum for which an effect may be observed. Therefore, I used a 10-day interval before and after the exact conjunction as my first and last price parameter.

Results

The second table shows the percentage change across a series of 2-day intervals starting from 10 days before the conjunction to 10 days after. The first thing to notice is how unimpressive the averages are. The first column represents the longest 20-day window ("-10d 10d") and it was barely positive at 0.08%. The period leading up to the conjunction was slightly positive ("-10d 0d") at 0.10% while the 10-day period following the conjunction was slightly negative at -0.04%. This may confirm the widely held view that the period leading up to a conjunction of bullish planets will often be more bullish than the period that follows it.

Median vs Mean/Average

But we need to look more closely at the data and its distribution. The averages are skewed by the fact that the 2020 Covid crash occurred during a Venus-Uranus conjunction (on March 8). This produced an outsized decline for these intervals including a 22.77% decline in the 20-day window ("-10d 10d"). No other conjunction in the dataset comes close to this kind of exaggerated result. Therefore, we should avoid making any conclusions about the market effects of this conjunction using the average or mean. Moreover, the huge standard deviation of 4.20% of the data suggests the wide distribution of the data cannot be accurately represented by an average. As a statistical rule of thumb, a widely skewed set of data is better summarized through the median, which is the middle value in a dataset, i.e. it is the value having an equal number of values above it as below it. Since these data are widely skewed, we are better served by focusing on the median.

The median here is 1.10% which is well above the expected value of 0.36% based on a 6.5% average annual return for 1960-2024. The median here is evidence of a bullish bias through this 20-day window around the conjunction. However, the highly skewed data shows up once again in the fact that just 61% of the conjunctions produced a positive result. This may sound bullish but it is worth noting that the probability that stocks rise on any given day is already 54%, and that probability rises to about 57% for any 20-day period. So 61% is greater than 57%, but not by much. And that 4% difference could even disappear completely given a larger dataset.

Other intervals show generally similar results. The medians are all above the corresponding expected values for each interval and the first half of each period is a bit more positive than the second half. The most bullish interval is the shortest: the 4-day window ("-2d 2d") had a median of 0.34% which was almost 5 times the expected value of 0.07%. However, positive results were only observed in 65% of cases. This is a pretty small effect compared with a 55% probability of gains for any random 4-day period. Again, the wide distribution of the data means that many Venus-Uranus conjunctions will coincide with negative market outcomes.

Conclusions

The evidence presented here suggests that the Venus-Uranus conjunction is slightly bullish for stocks. While the effect is measurable across a 20-day window, it is somewhat stronger in a narrow 4-day window right around the time of the conjunction. That said, this is very modest effect (about 1% through 20 days) and has a very wide distribution of outcomes. In other words, it is not a reliable bullish influence.

As we approach the next Venus-Uranus conjunction on Friday, July 4, we should be cautious about making any assumptions about possible market direction this week. Though slightly bullish in its effects, it remains to be seen if it will be enough to offset the bearish bias of the separating Jupiter-Saturn and Jupiter-Neptune squares and the separating Sun-Jupiter conjunction. As with all things astrological, we have to take the weight of all the evidence in order to evaluate the probabilities.

Based on my previous studies, there seems to be more evidence on the bear side of the ledger in the near term. Of course, this bearish evidence is also modest in scope and is not a basis for a trading strategy. Like standard seasonality statistics, this planetary seasonality provides only a backdrop of potentialities and cannot predict outcomes with certainty.